Your IR35 questions answered

If you can’t find an answer to your question please speak to us. We’re here to provide the answers you need.

What is IR35?

IR35 aims to ensure that freelancers who act and are treated like employees pay broadly the same tax and National Insurance as employees, regardless of the intermediary structure they work through. Structures targeted by IR35 include limited companies, often known as personal service companies (PSC), partnerships or individuals just there to receive payments.

Who does IR35 impact?

Up until April 6 2021, freelancers who used intermediary structures were responsible for deciding their own employment status for each contract, and the tax liabilities if they got it wrong. After April 6 2021, the responsibility - and liability - shifted to clients of those freelancers as long as those clients were ‘not small’. Not small means two of three tests: turnover of more than £10.2m, a balance sheet of more than £5.1m or an average of more than 50 employees. HMRC will include group and related companies as an anti-avoidance measure.

If you don’t act, what could happen?

If your business is ‘not small’ and you engage limited company freelancers you are liable for the income tax and national insurance that they have not paid on their entire invoice values with you. You could also face interest charges and penalties.

How has this impacted business in general?

Most industries used some level of Freelance contractors, who prior to 2021 were set up as limited companies. They were particularly prevalent in banking, IT, accountancy, and creative industries. Many of those freelancers now operate via PAYE umbrella companies.

How is this affecting construction?

The vast majority of self-employed individuals in the construction industry are sole-traders registered under CIS rather than being set up as limited companies, and therefore they are not affected by IR35. The freelance contingent within construction are generally those providing professional services outside CIS such as planners, land surveyors, quantity surveyors, architects and consulting engineers. Some remain limited, where they can demonstrate they comply with IR35, some have been absorbed by their most regular clients as employees, and some have chosen to retire altogether.

Is there a magic wand for IR35?

Unfortunately not. Generic questionnaires and declarations are not enough, and third party insurance policies are unlikely to pay out. IR35 is also very cleverly designed to leapfrog agencies, commercial contractors and anyone who sits between your business and a limited company contractor if IR35 applies.

The only way to deal with IR35 properly is to deploy an ongoing process of assessment and audit, making sure only IR35 compliant freelancers are used under IR35 compliant contractual terms.

The role of Hudson?

Hudson enables firms to engage IR35 compliant self-employed consultants, professionals and technicians without the financial fear and administrative burdens of dealing with IR35 themselves. To do this we have developed an IR35 compliant contract and auditing process that allows us the confidence to indemnify the outcome for the people we are willing to engage.

The moral of the story?

If IR35 is dealt with properly it should not do any significant damage, but avoid any over simplistic offerings which would give you the ability to pay anyone under a limited company as before the 2021 reform.

We are offering no-obligation consultations for construction companies. Call Hudson on 0800 054 1127 and ensure you are compliant with the regime.

Are you a freelancer working through your own limited company?

You may well find yourself in a situation where clients are insisting you should be taxed as an employee or that you have to use an umbrella company to process PAYE payments to you because of IR35 - even when there is compelling evidence that you are legitimately operating as a business outside the scope of IR35.

Hudson Freelance has been designed to meet the specific needs of freelance engineers, technicians and consultants supplying professional services to the construction sector, but fall outside the scope of HMRC’s Construction Industry Scheme (CIS).

If the circumstances under which you provide services are consistent with the contractual terms that we provide, and you are willing to take part in our auditing, there is absolutely no danger of your clients being hit with unexpected tax demands which they fear may be likely because of the April 2021 changes to IR35.

With the IR35 risk dealt with, a major barrier to your business is removed.

Call Hudson today on 0800 054 1127 for more information.

We also run a rewards scheme if you refer a construction company to us.

If you are not a Hudson client we are offering no-obligation consultations for construction companies worried about IR35.

Call 0800 054 1127 and ensure you are compliant with the legislation.

Latest Construction News

News

Refer a Friend and Receive £40 Now

We’re offering retail vouchers worth £40 for every eligible construction company* you refer to us before midnight on 29th August.

23rd June 2025

News

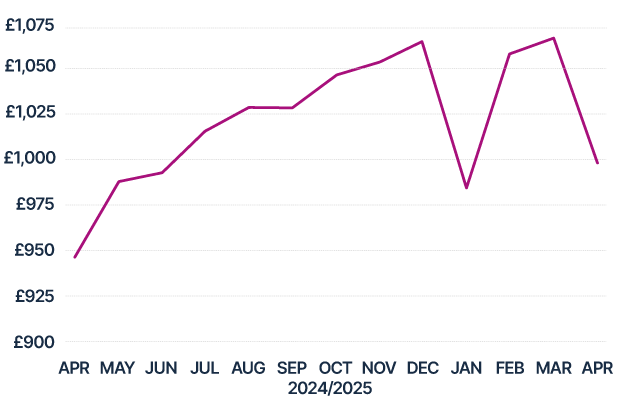

Freelance Builder Pay Trends: April 2025

Latest analysis is based on weekly payments to self-employed tradespeople made on behalf of thousands of construction SMEs

27th May 2025

News

Crackdown on umbrella companies to hit housebuilders and property developers

Watch our MD Ian Anfield explain what the changes mean

27th May 2025

News

Construction firms warned about payroll VAT fraud

Firm faces £2.4m tax bill plus penalties and costs after tribunal rules that companies remain responsible for compliance

23rd May 2025

To speak to one of our team, call us on 01262 401040

Or request a callback and one of our team will be in touch at a time that suits you.

Request a callback

Please select your role and fill in your details and we'll get you the right person to call you: