Your CIS questions answered

If you can’t find an answer to your question please speak to us. We’re here to provide the answers you need.

Do you have to register, and what will you have to do?

The Construction Industry Scheme (CIS) is a construction specific tax regime that allows HMRC to trace transactions and collect tax. Contractors are required to report who they pay each month and to deduct CIS tax from subcontractor payments. HMRC determine the tax deduction rate, usually 0% for large subcontract firms, 20% for self-employed individuals and small firms, and 30% for individuals and firms not properly registered.

Who does it apply to?

CIS applies to all contractors and subcontractors, individuals and firms, who carry out construction work in the UK.

Are you a contractor or a subcontractor?

If you do work for the ultimate end user you are a contractor, if you do work under a subcontract for a larger contractor you are a subcontractor. Most Hudson clients are both because they carry out specialist subcontract work for a main contractor, but they also pay subcontract firms and self-employed subcontractors.

What work is covered under CIS?

Basically all construction work that includes an on-site labour element is covered by CIS. Things like manufacturing only, delivery only, none operated plant are not covered whereas manufacture and installation would be, the cost of delivery in with that would be, and operated plant would be.

What do you need to do?

Contractors and subcontractors are required to register with HMRC’s Construction Industry Scheme.

Registered contractors must then report transactions to HMRC monthly, check on subcontractor deduction rates (known as verification) and pass any money deducted over to HMRC.

All deductions must be passed on to HMRC.

What happens if you fail to pay?

As the contractor, it’s your responsibility to deduct the right amount of tax from your subcontractors and to pay it over in the correct timescale. If you fail to administer CIS correctly, you may be faced with a fine of up to £3,000 plus any tax loss, and as a business the loss of gross payment status.

I am still not sure, where do I get help?

You are in the right place reading this website. Contact us and we would be happy to advise, carry out a free health check and supply chain due diligence. Our aim is to leave you with a fully compliant system so there are no nasty surprises should you be inspected by HMRC.

Part of what we do will mean that the verifying and reporting of lots of individual subcontractors becomes our responsibility, you just verify and report on Hudson.

Latest Construction News

News

Refer a Friend and Receive £40 Now

We’re offering retail vouchers worth £40 for every eligible construction company* you refer to us before midnight on 29th August.

23rd June 2025

News

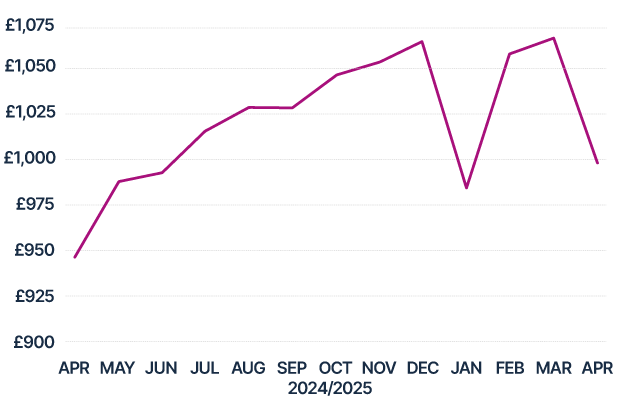

Freelance Builder Pay Trends: April 2025

Latest analysis is based on weekly payments to self-employed tradespeople made on behalf of thousands of construction SMEs

27th May 2025

News

Crackdown on umbrella companies to hit housebuilders and property developers

Watch our MD Ian Anfield explain what the changes mean

27th May 2025

News

Construction firms warned about payroll VAT fraud

Firm faces £2.4m tax bill plus penalties and costs after tribunal rules that companies remain responsible for compliance

23rd May 2025

To speak to one of our team, call us on 01262 401040

Or request a callback and one of our team will be in touch at a time that suits you.

Request a callback

Please select your role and fill in your details and we'll get you the right person to call you: