11th February 2016 | Ian Anfield

With the tax year end and self-assessment all filed with HMRC, many people are now sitting back and thinking, “Thank goodness that’s over for another year!”

But not HMRC.

Recent press reports have highlighted the additional resources HMRC have at their disposal to weed out errors and anomalies in tax returns. And it’s not just individuals that can come into scope. We are noticing an increase in company inspections as the result of an individual’s tax return information.

HMRC’s most powerful weapon can be summed up in a single word: data. Never has the technology been so powerful, facilitating a 360° view of an individual’s financial circumstances. Information gathered and held includes bank interest paid, Land Registry changes, DVLA and company. According to accountants and business advisors BDO, HMRC’s Connect system accesses thirty separate databases, analyses the information it retrieves for tax anomalies, and triggers investigations.

With 3,200 HMRC specialist investigators and 28,000 staff tackling non-compliance, employees have been tasked with bringing in as much revenue as possible. So whilst the vast majority of errors that flag up are a result of ‘failing to take reasonable care’, HMRC is increasingly reluctant to accept that errors are straightforward mistakes.

No longer a numbers game

As a recent statement explained: “The number of inquiries we open up is not a numbers game at all. The compliant majority won’t ever be bothered by us, we have zero interest in their tax returns. But those who are non-compliant will be asked questions by HMRC. Only taxpayers who have done something wrong need to worry.”

HMRC key triggers include suspected overstatement of expenses and understatement of turnover, and we are now seeing this impact on construction companies; we are aware of a few instances where an investigation into individuals that have all sub-contracted to one contractor were investigated, and the knock-on effect resulted in the contractor having to deal with a compliance investigation.

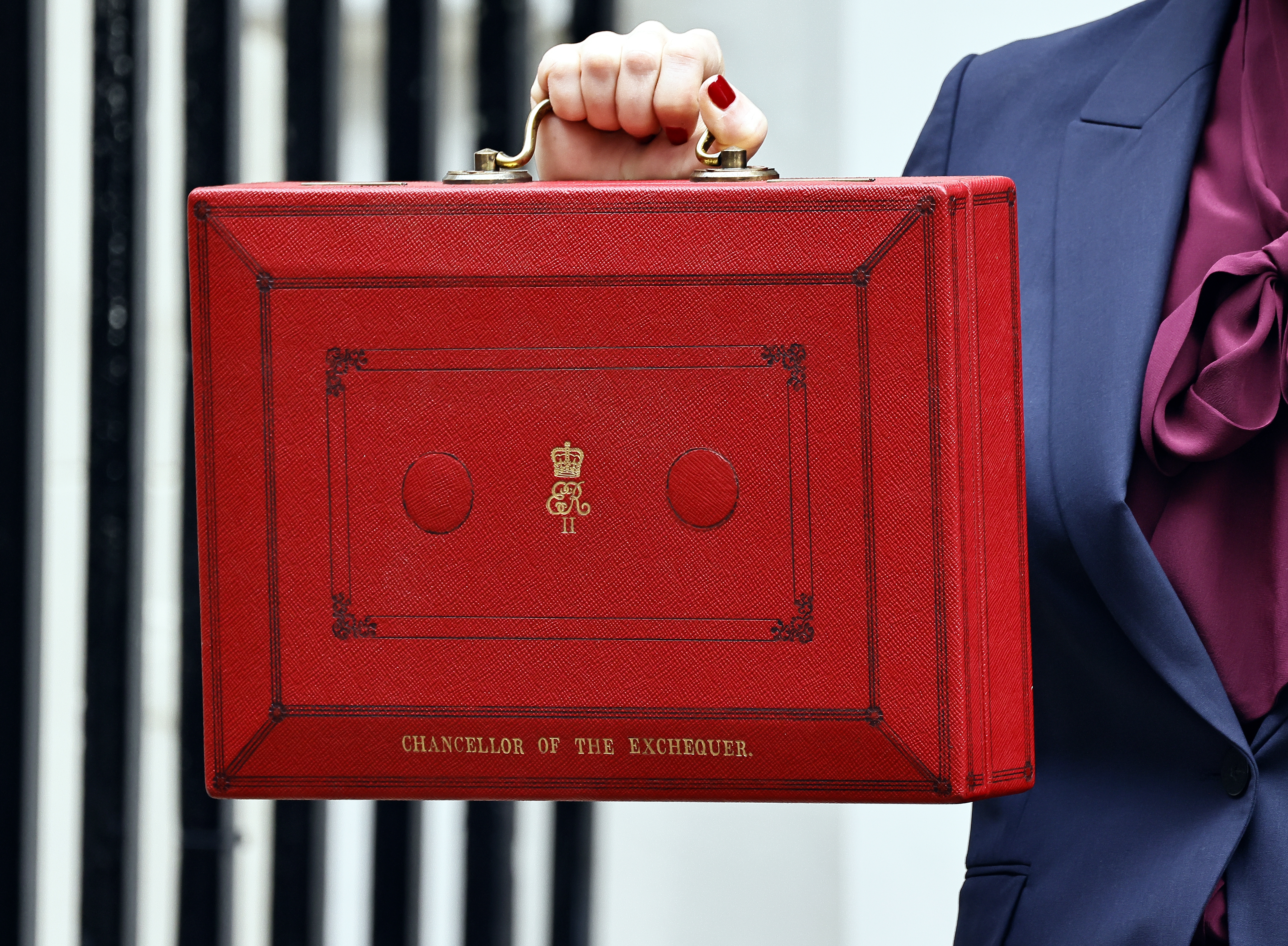

On a larger scale, the yield from tax compliance investigations is increasing, but not at the level that the Treasury expected.

OEI revenue falls short: HMRC looks to step up its activity

Last year’s Autumn Statement revealed the yield from Onshore Employment Intermediaries legislation has turned out to be £0.3 billion less than expected in both 2014-15 and 2015-16. HMRC will look to recoup the shortfall in the coming years though compliance activity.

Keeping your records up to date and accurate are key to your businesses success. If you have any doubts about your own records or know someone who could do with help from Hudson Contract, please contact us.