Why Hudson?

Keeping pace with the UK’s ever-changing tax and employment rules and regulations can be challenging and stressful to manage. That’s why more than 2,600 construction firms trust Hudson to navigate those concerns for them. Put simply, we eliminate risk from day one. Not just for employment status but through an industry standard-setting range of services that includes: supply chain due diligence, audits, mock inspections, HMRC representation and employment law guidance. We like to keep things simple while offering a level of protection and reassurance you won’t find anywhere else.

What we do

Hudson, in a nutshell

INDUSTRY

LEADER

In CIS compliance with 1.8m payments per year.

VALUED

PARTNER

Of more than 2,600 construction firms large and small.

NATIONAL

COVERAGE

Via regionally-based account managers.

IN BUSINESS

28 YEARS

Established in 1996.

FREE COMPLIMENTARY

SERVICES

Supply chain due diligence, dispute resolution, 4Site app and representation.

100% RATE OF

SUCCESS

We’ve never lost a status case against HMRC or at tribunal.

Latest Construction News

News

Refer a Friend and Receive £40 Now

We’re offering retail vouchers worth £40 for every eligible construction company* you refer to us before midnight on 29th August.

23rd June 2025

News

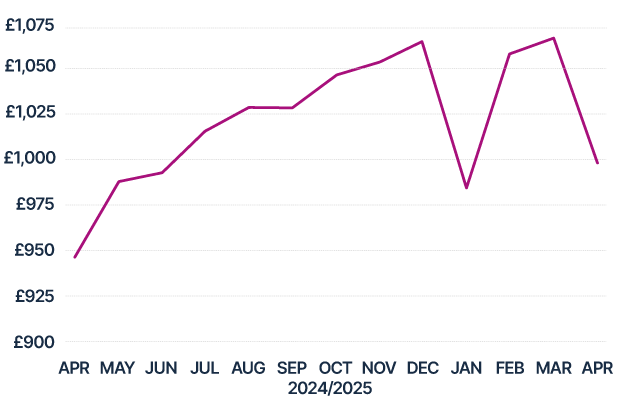

Freelance Builder Pay Trends: April 2025

Latest analysis is based on weekly payments to self-employed tradespeople made on behalf of thousands of construction SMEs

27th May 2025

News

Crackdown on umbrella companies to hit housebuilders and property developers

Watch our MD Ian Anfield explain what the changes mean

27th May 2025

News

Construction firms warned about payroll VAT fraud

Firm faces £2.4m tax bill plus penalties and costs after tribunal rules that companies remain responsible for compliance

23rd May 2025

To speak to one of our team, call us on 01262 401040

Or request a callback and one of our team will be in touch at a time that suits you.

Request a callback

Please select your role and fill in your details and we'll get you the right person to call you: